Car loans are a common way for individuals to finance their vehicles. However, finding the best car loan rates can make a significant difference in the overall cost of purchasing a car. It can be tough to decide where to start.

That’s why we’ve compiled a comprehensive guide to help you find the best car loan rates in the USA for both new and used cars.

In this article, we’ll discuss the factors to consider when looking for car loan rates, the best rates for new and used cars, and provide tips for getting the best car loan rates. Although you can refinance your car loan with the same bank.

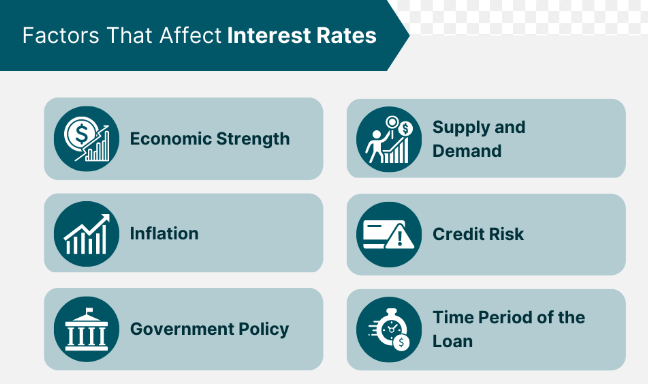

Factors to consider when looking for car loan rate

When it comes to finding the best car loan rates, there are several factors to consider. The first and most crucial factor is your credit score. Your credit score plays a significant role in determining the interest rate you’ll receive on your car loan. The higher your credit score lower will be the interest rate. If your credit score is not in good shape, you may want to take some time to improve it before applying for a car loan.

Another critical factor is the loan term. The longer the loan term, the more you’ll end up paying in interest over time. Shorter loan terms typically have higher monthly payments, but you’ll save money in the long run. Additionally, the down payment you can make also affects your car loan rates. A larger down payment can lower your interest rate and reduce the overall amount you need to borrow.

It’s important to shop around and compare rates from different lenders to find the best car loan rates. Different lenders may offer different rates based on their requirements and policies, so it’s crucial to do your research and compare offers. Consider getting pre-approved for a car loan, which can help you lock in a rate and make the car-buying process more manageable. By considering all these factors and taking the time to shop around, you’ll be able to find the best car loan rates for your needs.

Best car loan rates for new cars

Here are some of the top lenders offering the best car loan rates for new cars:

- Bank of America – Bank of America offers car loans with competitive interest rates starting at 2.49% APR for new cars. They offer loan terms ranging from 12 to 75 months and do not charge any application or prepayment fees.

- LightStream – LightStream is an online lender that offers car loans with rates as low as 1.99% APR for new cars. They offer flexible loan terms ranging from 24 to 84 months and do not require a down payment or charge any fees.

- Capital One – Capital One offers car loans with rates starting at 2.99% APR for new cars. They offer loan terms ranging from 36 to 72 months and do not charge any application or prepayment fees.

- Carvana – Carvana is an online car dealership that offers to finance with rates starting at 3.9% APR for new cars. They offer loan terms ranging from 36 to 72 months and do not charge any application or prepayment fees.

- PenFed Credit Union – PenFed Credit Union offers car loans with rates as low as 1.39% APR for new cars. They offer loan terms ranging from 36 to 84 months and do not charge any application or prepayment fees.

It’s important to note that the rates offered by these lenders may vary based on factors such as credit score and loan term. Be sure to shop around and compare offers from multiple lenders to find the best car loan rates for your specific situation.

Best car loans rates for used cars

Here are some of the top lenders offering the best car loan rates for used cars:

- Capital One. Capital One offers car loans with rates starting at 3.39% APR for used cars. They offer loan terms ranging from 36 to 72 months and do not charge any application or prepayment fees.

- Alliant Credit Union. Alliant Credit Union offers car loans with rates as low as 2.74% APR for used cars. They offer loan terms ranging from 12 to 84 months and do not charge any application or prepayment fees.

- Bank of America. Bank of America offers car loans with rates starting at 2.99% APR for used cars. They offer loan terms ranging from 12 to 75 months and do not charge any application or prepayment fees.

- PenFed Credit Union. PenFed Credit Union offers car loans with rates as low as 1.99% APR for used cars. They offer loan terms ranging from 36 to 84 months and do not charge any application or prepayment fees.

- Navy Federal Credit Union. Navy Federal Credit Union offers car loans with rates as low as 1.79% APR for used cars. They offer loan terms ranging from 36 to 96 months and do not charge any application or prepayment fees.

It’s important to note that the rates offered by these lenders may vary based on factors such as credit score, loan term, and the age and condition of the used car.

Tips for getting the best car loans rates

Getting the best car loan rates requires some research, planning, and effort on your part. Here are some tips and advice to help you secure the best rates for your car loan:

- Improve your credit score: Your credit score is one of the key factors that lenders consider when determining your interest rate. If your credit score is low, consider taking steps to improve it before applying for a car loan. This can include paying off outstanding debts, correcting errors on your credit report, and making all of your payments on time.

- Consider a shorter loan term: While longer loan terms may seem more appealing because of their lower monthly payments, they can end up costing you more in interest over the life of the loan. Consider opting for a shorter loan term, which can help you save money on interest and pay off your car loan faster.

- Negotiate with lenders: Don’t be afraid to negotiate with lenders to get the best possible interest rate. Compare rates from multiple lenders and use this information to negotiate with them. You can also ask if they offer any discounts or promotions, such as a lower rate for automatic payments.

Conclusion

Securing the best car loan rates is important for saving money and reducing the overall cost of your car purchase. By considering factors such as your credit score, loan term, and down payment, you can choose the right lender and interest rate for your needs. When looking for the best rates, it’s important to shop around and compare offers from multiple lenders.

Additionally, by following tips such as improving your credit score, considering a shorter loan term, and negotiating with lenders, you can save money on your car loan and get the best possible interest rate. With these strategies in mind, you can make a smart and informed decision when financing your next car purchase.