If you’ve had an auto loan with your bank for more than 10 years, you may be eligible for a rate reduction or a switch to another financial institution.

if someone recently made a massive move in his financial life. they will always want to get rid of their car loan. He has been paying it for a long time but has been dreaming of being debt free forever. Now that he finally got rid of his loan, he has the chance to shift to a better bank with higher rates and more financial flexibility. He does not know how to go about turning his current loan to a different bank. To figure out how to do this, he decides to consult with us and get in touch with us for some advice.

If you’re struggling with your auto loan payments, maybe you can get a better deal by switching your loan to another bank. But if that’s the case, then you might want to read the following article to find out whether you can get away with doing that.

What is an auto loan?

It’s a loan that doesn’t require any down payment. Typically, the term is three years, but they can be extended or paid off early if you want. They’re usually very expensive, so be careful when choosing your terms.

An auto loan is just a car loan with a few extra features. The features include a new repayment plan, new payment options, a lower interest rate, and an interest rate cap.

An auto loan is a short-term loan secured by a borrower’s car. The typical loan term is 3 years, but terms vary from 1 to 5 years. Loans are available in all 50 states; however, the maximum loan amount varies by state. Loan amounts generally range from $5,000 to $75,000, depending on the model and year of the vehicle. Depending on your credit history, you may qualify for a lower interest rate or a higher loan limit.

How can a person shift his auto loan to another bank?

How to Shuffle Your Auto Loan: There are a lot of ways to pay off your auto loans in the right order and at the right rate. Here are some tips on how to do it yourself. First, get your loan payments to match up with your spending habits. Once that’s done, it’s time to switch banks and start paying off your loan using your new bank’s terms and conditions. That means setting up automatic bill pay, getting your direct deposit set up, and learning how to pay off your car loan. It’s important to remember that all of these steps take time and energy, so you’ll need to be persistent and consistent. instead of switching bank account person can also empty his bank account before the divorce.

Things to consider before shifting your auto loan

When it comes to deciding which auto, loan is right for you, there are a lot of things to consider.

These include

- The length of the loan

- Down payment amount

- Monthly payments

- Interest rates

- Credit score.

Types of auto loans:

There are two basic types of loans:

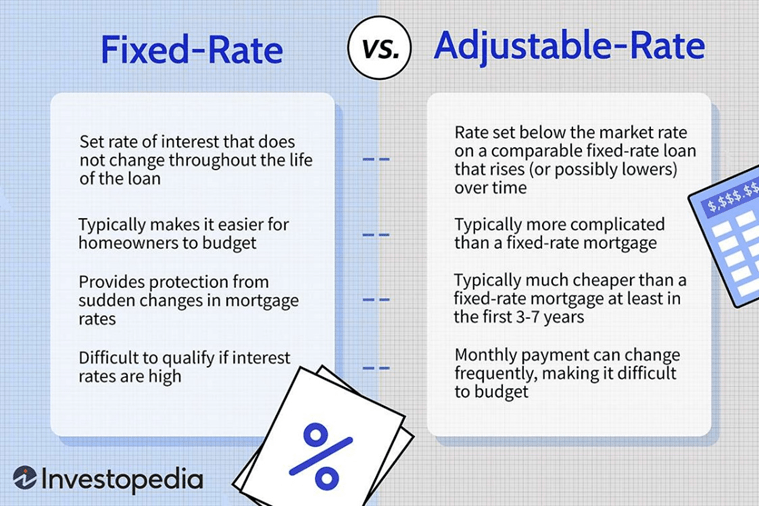

- Fixed-term

- Variable rate

- FIXED TERM:

The terms of an auto loan should match the length of the loan. As far as a fixed-term loan is concerned, this means that the payment period should be equal to or greater than the length of the loan. This is because a loan is only worth as much as the money it’s going to take to pay off. By having a longer term, you are paying a higher amount of money.

2. VARIABLE RATE

They offer lower monthly payments than fixed-rate car loans but also come with a few disadvantages. For example, variable rates are not set in stone, so they could change at any time without warning which means that if interest rates rise, so will your monthly payment.

Pros & Cons of shifting auto loan from one bank to another bank:

| PROS | CONS |

| You will get better rates and terms than what you are currently getting, which can save thousands of dollars in interest payments over the life of your loan. | You might be charged a fee for closing your original loan and opening a new one. This might be in the form of an early termination fee, or it could be a charge for setting up the new account. |

| You will get better rates than other banks. | There is no guarantee that refinancing will result in lower monthly payments or better terms than what you already have with your current lender. |

| If your credit score has improved, it may be possible to qualify for a lower interest rate, which can save you money over time. | You might also have to pay interest on your balance if you’re not paying off your loan every month. |

CONCLUSION

A quick and easy way to refinance your car loan, whether you’re switching lenders or moving companies, is to contact your existing auto lender. Most banks will happily offer you a personal loan at the same interest rate and terms you currently pay to finance the vehicle. However, remember that this approach is only valid if you’ve been paying off your auto loan for six months or more. If you’re considering changing lenders, you may want to wait until you’ve paid off your loan before moving.

Hundreds of lenders and brokers in the market offer auto loan refinancing. But, not all of them can provide a smooth process and hassle-free services. Therefore, it is advisable to find a reliable lender before taking the step of refinancing to another bank.