In today’s fast-paced world, unexpected financial emergencies can arise at any moment, leaving individuals and families scrambling for immediate solutions. Whether it’s a medical expense, car repair, or an unforeseen bill, the need for quick cash can be overwhelming. Thankfully, short-term loans have emerged as a viable option, providing individuals with easy approval and rapid access to funds.

In this article, we will explore the world of easy approval on short-term loans, shedding light on their benefits, application process, and how they can serve as a lifeline during financial emergencies.

Understanding Short-Term Loans

What are Short-Term Loans?

Short-term loans, also known as payday loans or cash advances, are small-dollar loans typically meant to be repaid within a short duration, usually within a few weeks or months. These loans are designed to provide immediate financial assistance to individuals facing temporary cash flow problems.

The Benefits of Short-Term Loans

Short-term loans offer several advantages, making them an attractive option for individuals seeking quick financial assistance:

1. Easy Approval

Unlike traditional loans that involve a lengthy approval process, short-term loans are known for their relatively easy approval requirements. Individuals with less-than-perfect credit scores can also qualify for these loans, as they primarily focus on an applicant’s income and ability to repay the loan.

2. Quick Disbursement

When facing a financial emergency, time is of the essence. Short-term loans provide rapid access to funds, with many lenders offering same-day or next-day disbursement. This quick turnaround ensures that borrowers can address their immediate financial needs promptly.

3. Minimal Documentation

Unlike traditional loans that require extensive documentation, short-term loans have minimal paperwork involved. Usually, borrowers need to provide proof of income, identification, and a valid bank account. This streamlined process makes it convenient for individuals seeking urgent financial assistance.

4. Accessibility

Short-term loans are accessible to a wider range of individuals, including those with poor credit scores or no credit history. Lenders typically have less stringent requirements for short-term loans than for long-term loans, making it easier for borrowers to qualify.

5. Speed of Approval

Short-term loans are designed to provide quick cash to borrowers in need. As such, the approval process for short-term loans is typically much faster than for other types of loans. Some lenders offer same-day or next-day approval, allowing borrowers to get the money they need quickly.

6. Flexibility

Short-term loans offer more flexibility than long-term loans. Borrowers can choose the loan amount and repayment term that best suits their needs. This flexibility allows borrowers to customize their loans to their specific situation, making short-term loans an attractive option for many.

7. Less paperwork

Compared to long-term loans, short-term loans require less paperwork, making the application process much simpler and faster. Borrowers typically need to provide basic personal and financial information, making it easier to apply and get approved quickly.

8. Collateral-free loans

Most short-term loans are unsecured, meaning borrowers do not need to provide collateral to secure the loan. This reduces the risk for borrowers who may not have valuable assets to use as collateral. It also makes short-term loans a viable option for those who may not want to risk losing their assets if they default on the loan.

What to consider before applying for a Short-Term Loan?

Before applying for a short-term loan, there are several things you need to consider. These include determining your needs, assessing your ability to repay, researching lenders and comparing options, understanding the fees and interest rates, and checking for hidden fees.

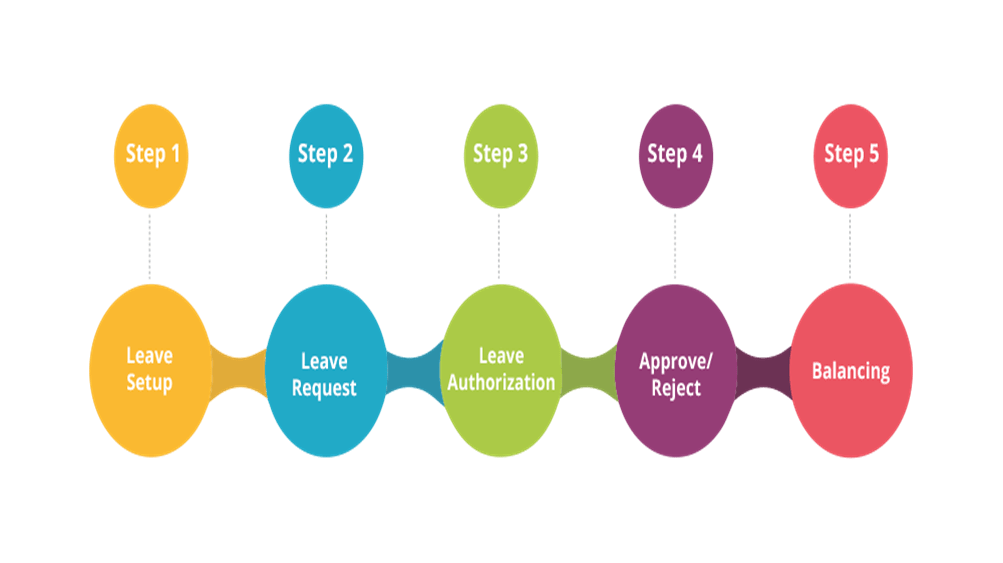

The Application Process for Easy Approval

1. Finding the Right Lender

When applying for a short-term loan, it is crucial to choose a reputable and trustworthy lender. Conduct thorough research, read customer reviews, and compare interest rates and terms offered by different lenders. This step will ensure that you enter into a loan agreement with a lender who is transparent and offers favorable terms.

2. Gathering the Required Documents

Before initiating the application process, gather the necessary documents to streamline the process. Typically, you will need to provide proof of income, such as pay stubs or bank statements, along with identification documents like a driver’s license or passport.

3. Filling out the Application

The loan application will require you to provide personal information, including your name, contact details, employment information, and banking details. Ensure that you provide accurate and up-to-date information to expedite the approval process.

4. Submitting the Application and Approval

After completing the application, submit it to the lender for review. Many lenders offer online application options, allowing for a convenient and hassle-free submission. Upon submission, the lender will evaluate your application, considering factors such as income, employment stability, and credit history. If approved, you will receive a loan agreement outlining the terms and conditions, including repayment terms and interest rates. For more information, you can study how to get approved for a short-term loan.

Responsible Borrowing and Repayment

1. Borrowing Within Your Means

While short-term loans can provide immediate relief, it is crucial to borrow only what you need and can comfortably repay. Carefully assess your financial situation and determine the amount required to cover your emergency expenses. Borrowing more than necessary can lead to increased debt and financial strain in the long run.

2. Understanding Repayment Terms

Before accepting a short-term loan, thoroughly review the repayment terms outlined in the loan agreement. Take note of the due date, interest rates, and any applicable fees or penalties for late payments. It is essential to have a clear understanding of your repayment obligations to avoid any unexpected financial burdens.

3. Creating a Repayment Plan

To ensure timely repayment, create a repayment plan that aligns with your budget and income. Prioritize the loan repayment and allocate sufficient funds each month to cover the installment. Consider setting up automatic payments or reminders to avoid missing any payments and incurring additional fees.

4. Communicating with the Lender

If you encounter any difficulties or foresee challenges in making timely repayments, it is crucial to communicate with your lender proactively. Many lenders are willing to work with borrowers to find alternative repayment options or modify the loan terms. Ignoring the issue can lead to increased debt and damage to your credit score.

Conclusion

Easy approval on short-term loans can be a lifeline for individuals facing unexpected financial emergencies. With their quick approval process, minimal documentation, and rapid access to funds, these loans provide a convenient solution during times of urgency. However, responsible borrowing and diligent repayment are essential to avoid falling into a cycle of debt.

Before applying for a short-term loan, thoroughly research lenders, compare terms and interest rates, and assess your ability to repay the loan. Remember to borrow only what you need and create a realistic repayment plan. By utilizing short-term loans responsibly, you can effectively manage unforeseen expenses and regain financial stability.

In summary, easy approval on short-term loan offers a practical solution for individuals in need of quick financial assistance. With careful consideration and responsible borrowing, these loans can serve as a valuable resource in times of urgency.