For individuals relying on Supplemental Security Income (SSI) benefits you have to understand the time of SSI direct deposit into their bank account is paramount. SSI benefits serve as a lifeline for many. Which provides financial support to elderly, blind, and disabled individuals with limited income and resources. Knowing exactly when these funds will be available allows recipients to effectively budget their expenses. Which ensures they can meet their basic needs and maintain financial stability.

In this comprehensive guide, we will delve into the intricacies of SSI direct deposits. Exploring the process of claiming benefits, the payment schedule, and the various factors that influence deposit times. By gaining a thorough understanding of these aspects. Recipients can navigate the complexities of the SSI program with confidence and ensure timely access to their much-needed funds.

Understanding SSA or Social Security

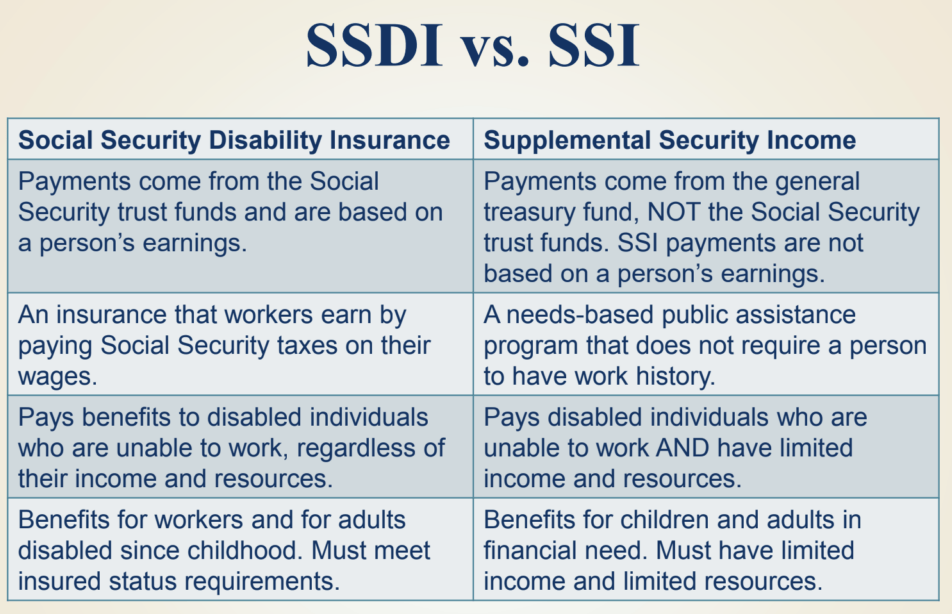

The Social Security Administration (SSA) stands as a pillar of support for millions of Americans. Which offers various programs aimed at providing financial assistance to those in need. Among these programs is Supplemental Security Income (SSI), designed to assist elderly, blind, and disabled individuals with limited income and resources. Unlike other Social Security programs based on work history and contributions. SSI benefits are need-based, making them accessible to individuals facing financial hardships regardless of their work history. To qualify for SSI benefits, applicants must meet specific eligibility criteria, including age, disability status, and financial need. Understanding the role of the SSA and the eligibility requirements for SSI benefits is crucial for individuals seeking financial assistance and navigating the application process successfully.

Navigating the complexities of the SSA and SSI programs requires a comprehensive understanding of the available benefits and the application process. Applicants must provide extensive documentation to verify their eligibility, including proof of income, resources, citizenship, and disability status. The SSA meticulously reviews each application to determine eligibility. Ensuring that benefits are allocated to those who meet the necessary criteria. Additionally, the SSA provides various resources and support services to assist individuals throughout the application process. Which including online portals and dedicated customer service representatives. By familiarizing themselves with the SSA’s role and the application requirements. Individuals can navigate the process more effectively and increase their chances of securing SSI benefits.

Claiming Your Benefits from SSA

Claiming Supplemental Security Income (SSI) benefits from the Social Security Administration (SSA). It involves a structured process designed to ensure that individuals in need receive the financial assistance they require. The first step in claiming SSI benefits is to apply to the SSA. Providing comprehensive documentation to verify eligibility. This documentation typically includes proof of income, resources, citizenship, and disability status. Applicants must thoroughly complete the application forms and provide accurate information to facilitate the review process.

Once the application is submitted, the SSA carefully evaluates each case to determine eligibility for SSI benefits. This evaluation involves assessing the applicant’s financial need, disability status, and other eligibility criteria specified by the SSA. The review process may take some time, as the SSA meticulously examines the documentation provided to make an informed decision.

Upon approval, recipients begin receiving their SSI benefits according to the SSA’s payment schedule. Recipients need to understand the payment methods available, including direct deposit into a bank account. The Direct Express® debit card program, and paper checks. Recipients can choose the method that best suits their needs and preferences. Overall, claiming SSI benefits from the SSA requires careful attention to detail and adherence to the application process to ensure timely access to much-needed financial assistance.

Payment Schedule for SSI Benefits

Supplemental Security Income (SSI) benefits are disbursed every month. Which provides recipients with a consistent source of income to cover their essential expenses. The Social Security Administration (SSA) follows a predetermined payment schedule for issuing SSI benefits. Ensuring that recipients receive their funds reliably each month. Typically, SSI benefits are paid on the first of every month. Which allows recipients to anticipate when they will receive their payments.

Recipients have several options for receiving their SSI benefits, including direct deposit into a bank account. The Direct Express® debit card program, and paper checks. Direct deposit is often the preferred method for its convenience and security. Funds are automatically deposited into recipients’ accounts on the designated payment date. This eliminates the need to wait for a check to arrive in the mail or visit a bank to cash it.

Understanding the payment schedule for SSI benefits enables recipients to plan their finances effectively and ensure timely access to their funds. By knowing when their benefits will be available each month, recipients can budget their expenses, pay bills on time, and manage their finances with confidence. Additionally, recipients should be aware that the payment schedule may be adjusted in cases where the first of the month falls on a weekend or holiday. Ensuring that funds are still accessible promptly. Overall, the payment schedule for SSI benefits provides recipients with a reliable source of income to support their needs and maintain financial stability.

Timeframe for SSI Direct Deposit

The timeframe for Supplemental Security Income (SSI) direct deposits varies depending on several factors, including the recipient’s financial institution and the processing times involved. While the Social Security Administration (SSA) typically releases funds on the first of each month. The actual deposit date may vary slightly. Most banks and credit unions credit SSI direct deposits early in the morning on the designated payment date. Ensuring that recipients can access their funds promptly.

However, the specific deposit time may differ between financial institutions. So, recipients should inquire with their bank to determine the typical deposit time for electronic transfers. Some banks may credit deposits earlier in the day, while others may do so later in the afternoon. Additionally, recipients should be aware that the timeframe for SSI direct deposits may be affected by weekends and holidays. In such cases, deposits scheduled for weekends or holidays are often credited on the preceding business day to ensure timely access to funds.

When Does SSI Direct Deposit Into a Bank Account?

Supplemental Security Income (SSI) direct deposits into bank accounts typically occur on the first of each month. However, the exact timing of the deposit may vary depending on several factors. Recipients should be aware that weekends and holidays can impact deposit times. If the first of the month falls on a weekend or holiday. Deposits are often credited on the preceding business day to ensure timely access to funds.

Additionally, the processing times of individual financial institutions can influence when funds are available in recipients’ accounts. While some banks credit SSI direct deposits early in the morning on the payment date. Others may do so later in the day. Recipients are advised to inquire with their bank to determine the typical deposit time for electronic transfers.

By understanding these factors and staying informed about their bank’s deposit policies. Recipients can ensure timely access to their SSI benefits. Planning and anticipating when funds will be available allows recipients to manage their finances effectively and meet their financial obligations with confidence. Overall, knowing when SSI deposits into their bank accounts provides recipients with peace of mind and financial stability.

Factors Affecting Deposit Time

Several factors can influence the timing of Supplemental Security Income (SSI) direct deposits into bank accounts. One significant factor is the recipient’s financial institution, as different banks may have varying processing times for electronic transfers. Some banks may credit SSI direct deposits early in the morning on the designated payment date, while others may do so later in the day. Recipients should inquire with their bank to determine the typical deposit time for electronic transfers.

Weekends and holidays also play a crucial role in affecting deposit times. If the first of the month, when SSI benefits are typically disbursed, falls on a weekend or holiday, deposits are often credited on the preceding business day. This ensures that recipients have timely access to their funds and can manage their finances effectively.

Additionally, special circumstances such as bank holidays or system maintenance periods may impact deposit times. Recipients should be aware of any such events that may affect the processing of their SSI direct deposits and plan accordingly. By understanding these factors, recipients can anticipate when their SSI benefits will be available and avoid potential delays in accessing their funds. Overall, being informed about the factors affecting deposit times empowers recipients to manage their finances efficiently and maintain financial stability.

Setting Up Direct Deposit for SSI Benefits

Setting up direct deposit for Supplemental Security Income (SSI) benefits is a straightforward process that offers numerous benefits for recipients. Direct deposit provides a convenient and secure way to receive SSI payments directly into a recipient’s bank account. Eliminating the need to wait for paper checks to arrive in the mail. To set up direct deposit, recipients can choose from several methods. Which includes online through the Social Security Administration (SSA) website or by contacting their bank directly.

Recipients opting to set up direct deposit online can do so through the SSA’s website, where they can provide their bank account information securely. Alternatively, recipients can contact their bank directly to initiate the direct deposit setup process.

Once direct deposit is established, recipients can enjoy the peace of mind of knowing that their SSI benefits. It will be deposited directly into their bank accounts on the designated payment dates. Direct deposit offers recipients greater convenience and security. As funds are automatically deposited into their accounts without the need for manual intervention. By setting up direct deposit for SSI benefits. Recipients can streamline their finances, ensuring timely access to their much-needed funds and maintaining financial stability.

Ensuring Timely Receipt of SSI Benefits

While the Social Security Administration (SSA) strives to process Supplemental Security Income (SSI) payments promptly. Recipients must also take proactive steps to ensure timely receipt of their benefits. Monitoring their bank accounts for deposit notifications is essential. As it allows recipients to promptly address any issues or discrepancies that may arise with their SSI deposits.

In cases where deposits are delayed or missing. Recipients should take immediate action by contacting the SSA or their financial institution for assistance. The SSA’s customer service representatives can provide valuable guidance and support in resolving deposit-related issues. Financial institutions can help investigate any potential discrepancies or delays in crediting deposits to recipients’ accounts.

By staying vigilant and proactive, recipients can ensure that they receive their SSI benefits on time and avoid any potential financial hardships. Regularly checking bank account balances and deposit notifications. Which enables recipients to stay informed about the status of their SSI deposits and take prompt action if any issues arise. Overall, ensuring timely receipt of SSI benefits requires recipients to actively monitor. Their accounts and promptly address any deposit-related concerns that may arise.

Conclusion

In conclusion, the timing of SSI direct deposit in a bank account is a critical aspect of financial management for recipients reliant on these benefits. By understanding the process of claiming SSI benefits, including the documentation required and the various claiming methods available, individuals can navigate the application process smoothly. Furthermore, being aware of the payment schedule. The factors influencing deposit times empower recipients to plan their expenses effectively and avoid financial difficulties.

Setting up direct deposit for SSI benefits offers recipients convenience and security. By taking proactive steps to monitor their bank accounts and promptly address any issues with delayed or missing deposits. Recipients can ensure timely access to their benefits and maintain their financial stability.

FAQs

- Q: What time does SSI direct deposit into bank accounts?

- A: SSI direct deposits typically occur on the first of each month, but the exact timing may vary depending on the recipient’s bank.

- Q: How can I set up direct deposit for my SSI benefits?

- A: Recipients can set up direct deposit online through the SSA’s website or by contacting their bank directly.

- Q: What should I do if my SSI deposit is late or missing?

- A: If your SSI deposit is delayed or missing, contact the SSA or your financial institution for assistance.

- Q: Can I change my direct deposit information for SSI benefits?

- A: Yes, recipients can update their direct deposit information online or by contacting the SSA.

- Q: Are SSI direct deposits affected by holidays or weekends?

- A: Deposits scheduled for weekends or holidays may be credited on the preceding business day to ensure timely access to benefits.