In the dynamic world of dentistry, achieving financial success is as crucial as providing top-notch patient care. As dental practitioners navigate the path toward growth and excellence, the role of business loans for dentists becomes increasingly pivotal. This comprehensive guide aims to illuminate the intricate landscape of dental financing. Which offers insights into the types of loans available, qualification criteria, and a step-by-step application process. From success stories of thriving dental practices to expert advice from financial gurus, this article is a roadmap for dentists seeking financial stability and the keys to unlocking the full potential of their practices.

The journey towards a flourishing dental practice begins with understanding the specialized financial tools designed for dentists. Whether you are a seasoned professional aiming to expand your practice or a recent graduate embarking on your entrepreneurial journey, business loans tailored for dentists can play a transformative role. Join us as we explore the nuances of these financial instruments, empowering you to make informed decisions that align with your practice’s unique needs.

What are Business Loans for Dentists?

Business loans for dentists serve as tailored financial instruments designed to meet the specific needs of dental professionals. Whether you’re looking to expand your practice, invest in state-of-the-art equipment, or manage cash flow effectively, these loans offer a lifeline for achieving your goals. Understanding the intricacies of these loans is paramount for any dentist aiming to elevate their practice to new heights.

Explore the significance of business loans for dentists in this section. From the foundational principles to the various purposes they serve, delve into how these specialized financial tools can be the catalyst for transformative growth in your dental practice. Real-world examples and testimonials from practitioners who have leveraged such loans will provide tangible insights, illustrating the tangible impact they can have on the success of your dental enterprise.

Importance in Dental Practice

The importance of business loans for dentists extends beyond mere financial transactions; it is a cornerstone for building and sustaining a successful dental practice. In this section, we delve into the critical role these loans play in the day-to-day operations and long-term goals of dental professionals.

Discover how business loans facilitate the modernization of equipment, enabling practitioners to stay at the forefront of dental technology. Additionally, explore their role in hiring skilled staff, expanding services, and creating a patient-centric environment. Real-world case studies will illuminate success stories, showcasing how strategic financing has been instrumental in turning dental practices into thriving, patient-focused establishments.

What are Different Types of Business Loans for Dentists?

- Term Loans

Term loans represent a fundamental financial tool for dental practitioners aiming for long-term stability and growth. In this section, we explore the benefits and considerations of opting for easy approval of short term loans. Which provides dentists with a comprehensive understanding of this foundational loan type.

Uncover how term loans offer repayment flexibility, making them suitable for various practice needs. Dive into case studies illustrating how dental professionals strategically utilized term loans to navigate challenges and achieve sustainable growth. Whether you’re a solo practitioner or part of a dental group, understanding the nuances of term loans is crucial for making informed financial decisions.

- Equipment Financing

Modern dental practices rely heavily on cutting-edge equipment, and financing these technological investments is paramount. In this subheading, we explore the specifics of equipment financing for dentists, shedding light on the benefits and considerations associated with this specialized loan type.

Learn how equipment financing can positively impact your practice by allowing you to stay current with technological advancements. Real-world examples will showcase how dental practitioners efficiently upgraded their equipment, resulting in enhanced patient care and improved operational efficiency. Whether you’re considering digital imaging systems or advanced treatment chairs.

Qualification Criteria

- Credit Score Requirements

Securing a business loan for your dental practice hinges on meeting specific credit score requirements. This section delves into the ideal credit score range for obtaining business loans for dentists, offering actionable tips on improving creditworthiness.

Explore the factors that lenders consider when evaluating credit scores and understand how a strong credit profile can unlock favorable loan terms. Practical advice and expert insights guide dental professionals through the process of strengthening their credit standing. Which ensures a smoother journey toward securing essential business financing.

- Documentation Needed

The paperwork involved in a business loan application can be overwhelming. However, understanding the documentation requirements is key to a successful process. In this subheading, we provide a detailed checklist, guiding dentists through the necessary paperwork with ease.

Navigate the maze of documentation, ensuring you have all the necessary financial records, business plans, and personal information ready for your loan application. Insights into common pitfalls and tips for efficient document preparation empower dental practitioners to streamline their application process and increase the likelihood of approval.

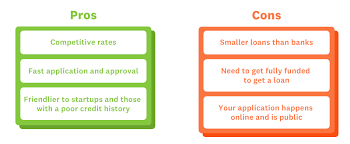

Pros and Cons of Business Loans for Dentists

- Advantages

Business loans for dentists come with a host of advantages that can significantly impact the success of your practice. This section outlines the various benefits, from flexible repayment options to fostering practice expansion.

Discover how these loans can be a strategic financial tool, allowing dentists to seize opportunities for growth without compromising financial stability. Real-life examples and success stories highlight the positive impact of business loans, providing inspiration for practitioners looking to take their dental practices to the next level.

- Potential Drawbacks

While business loans offer valuable financial support, it’s essential to be aware of potential drawbacks. In this section, we explore the challenges associated with business loans for dentists and provide insights on mitigating these risks.

Understanding the potential drawbacks, such as interest rates and possible financial strain, allows dental professionals to make informed decisions. Expert advice on risk management ensures that practitioners approach business loans with a clear understanding of both the benefits and potential challenges.

Application Process

- Step-by-Step Guide

Mastering the application process is crucial for securing business loans for dentists. In this section, we provide a step-by-step guide, demystifying the intricacies of applying for financial support tailored to dental practices.

Navigate through each stage of the application process with confidence, from initial research to final submission. Insights into common mistakes to avoid equip dental practitioners with the knowledge. It needed to present a compelling application, increasing the likelihood of approval.

- Common Mistakes to Avoid

Anticipating pitfalls in the loan application process is crucial for success. In this subheading, we explore common mistakes. That dental professionals often make during the application process and offer guidance on avoiding them.

Learn from the experiences of others, ensuring that your application stands out for all the right reasons. Proactive measures and strategic planning. It can significantly improve the chances of a successful loan application, setting the stage for financial prosperity.

Case Studies

- Success Stories

Real-world success stories provide tangible examples of how business loans have transformed dental practices. In this section, we delve into inspiring success stories, showcasing the impact of strategic financing on the growth and success of dental professionals.

Explore how practitioners leveraged business loans to overcome challenges, expand their services, and create thriving patient-centric practices. These success stories serve as a testament to the transformative power of well-utilized business loans for dentists.

- Lessons Learned

The journey to success often comes with valuable lessons. In this subheading, we examine the lessons learned by dental professionals who navigated the business loan landscape, providing actionable insights for those embarking on a similar journey.

Gain wisdom from those who have faced challenges, made strategic decisions, and achieved financial success through business loans. These lessons learned serve as a guide for dental practitioners, helping them navigate the complexities of the financial landscape with confidence.

FAQs

How to Improve Loan Approval Odds?

Securing a business loan is a significant step, and understanding how to improve approval odds is crucial. In this section, we address common questions related to boosting your chances of loan approval, offering practical tips and insights.

Explore actionable strategies for improving your creditworthiness, preparing a compelling loan application, and navigating the approval process successfully. Expert advice and real-world examples provide a comprehensive guide for dental professionals seeking to enhance their loan approval odds.

Repayment Options

Understanding repayment options is vital for a stress free loan experience. In this subheading, we demystify repayment terms, providing clarity on various options available to dental practitioners.

Explore flexible repayment plans, considerations for choosing the right option for your practice, and expert advice on managing loan repayments efficiently. This section empowers dentists to make informed decisions that align with their financial goals.

Expert Advice To Business Loans for Dentists

Tips from Financial Experts

Financial experts specializing in dental practice financing offer valuable tips and insights in this section. From maintaining a healthy financial profile to exploring tailored loan solutions, these experts provide actionable advice for dental professionals.

Benefit from the wisdom of financial gurus who understand the unique challenges of dental practices. Implementing these tips can pave the way for long-term financial success, ensuring that your practice thrives in a competitive landscape.

Navigating the Loan Market

The dynamic nature of the loan market requires dental professionals to stay informed. In this subheading, we explore strategies for navigating the loan market. Which ensures that practitioners make strategic financial decisions aligned with their practice goals.

Understand the trends, factors to consider when choosing a lender, and tips for securing favorable loan terms. Navigating the loan market with expertise ensures that dental practices thrive in the ever-changing financial landscape.

Conclusion

Summing up the key takeaways, this section provides a recap of the essential aspects covered in this comprehensive guide. Reinforcing key information ensures easy retention for dental practitioners looking to implement strategic financial decisions.

As the financial landscape evolves, anticipating future trends is essential. In this subheading, we offer a glimpse into the evolving landscape of business loans for dentists. Highlighting emerging trends that may shape the financial future of dental practices.

Explore how technology, market dynamics, and industry shifts may impact the availability and structure of business loans for dentists. Understanding future trends empowers dental practitioners to make proactive financial decisions that position their practices for continued success.

Additional Insights

Digital Transformation in Dental Practices

Embracing digital tools and technologies can positively impact your practice’s financial health. We explore how the digital transformation of dental practices, from online appointment scheduling to virtual consultations. Which contributes to financial success.

Sustainability Practices in Dentistry

Incorporating sustainable practices not only benefits the environment but also contributes to cost savings. This subheading explores eco-friendly equipment choices and waste reduction initiatives, showcasing the growing trend of sustainability in the dental industry.

Leveraging Social Media for Practice Growth

Harnessing the power of social media is crucial for practice growth. In this section, discover effective strategies for using platforms like Instagram and Facebook. Which engages with patients, showcases expertise, and attracts new clientele.