In today’s digital age, PayPal stands as a ubiquitous platform for online transactions, offering users the convenience of sending and receiving money with just a few clicks. Central to its functionality are the options to link either a bank account or a debit card to facilitate transactions. Understanding the nuances between these two methods can help users make informed decisions about their PayPal usage and security. In this comprehensive guide, we delve into the differences between linking a bank account and a debit card on PayPal, exploring the advantages, disadvantages, and considerations for each option.

Linking Debit Cards to PayPal

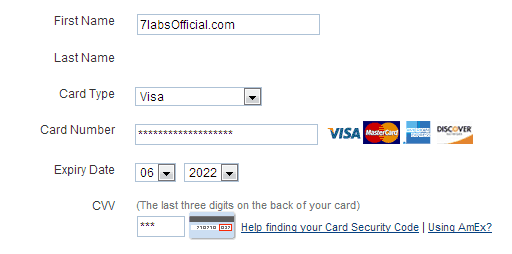

Difference Between Linking a Bank Account and Debit Card on PayPal. When users link a debit card to their PayPal account, they are essentially connecting their card details to PayPal’s platform. This allows them to make purchases directly from their linked debit card balance or withdraw funds from their PayPal account to their linked card. Linking a debit card offers a convenient way to access funds stored in the associated bank account without the need for additional transfers or transactions. Additionally, using a debit card for PayPal transactions can provide users with added security measures, such as fraud protection and purchase guarantees offered by their card issuer.

Linking Bank Account to PayPal

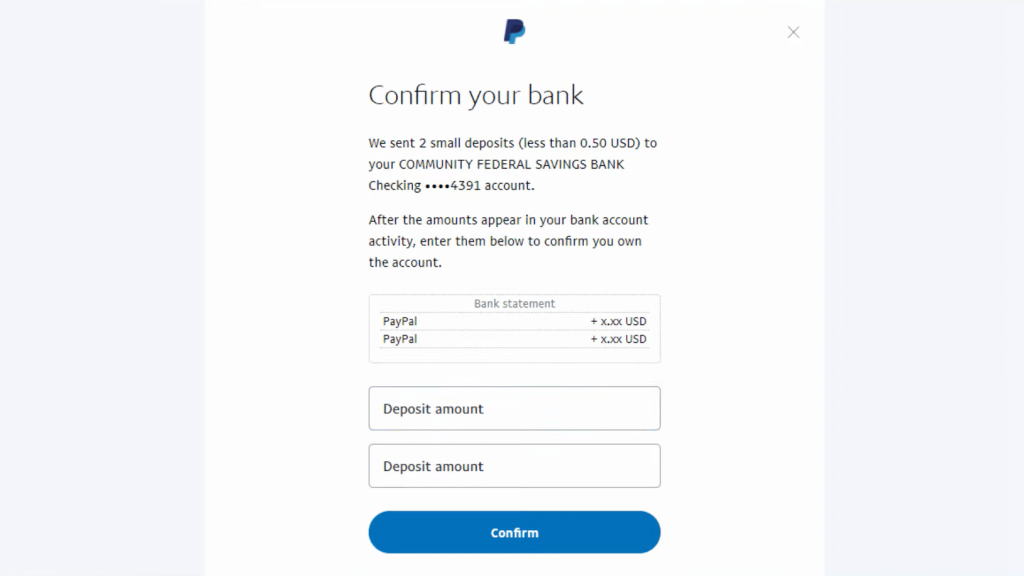

Alternatively, users can choose to link their bank account to their PayPal account, enabling direct transfers between the two accounts. When a bank account is linked, users can transfer funds from their bank account to their PayPal balance for future use or to complete transactions. Linking a bank account offers the advantage of avoiding transaction fees associated with using a debit or credit card for PayPal transactions. Additionally, it provides users with greater flexibility and control over their finances, as they can easily transfer funds between their PayPal account and bank account as needed.

Advantages of Linking a Bank Account to PayPal

Linking a bank account to PayPal offers several advantages for users. Firstly, it eliminates the need to rely on debit or credit cards for transactions, reducing the risk of card fraud or unauthorized charges. Secondly, it provides users with access to funds stored in their bank account without incurring transaction fees. Additionally, linking a bank account allows for seamless transfers between PayPal and the bank account, facilitating easy management of funds and transactions.

Advantages of Linking a Debit Card to PayPal

On the other hand, linking a debit card to PayPal offers its own set of advantages. Firstly, it provides users with immediate access to funds stored in their linked debit card balance, eliminating the need for additional transfers or transactions. Secondly, using a debit card for PayPal transactions may offer additional security measures, such as fraud protection and purchase guarantees provided by the card issuer. Additionally, linking a debit card can be advantageous for users who prefer the convenience of using a card for online transactions.

Pros of PayPal

Regardless of whether users choose to link a bank account or a debit card, PayPal offers numerous benefits as a payment platform. One of the key advantages of PayPal is its widespread acceptance among online merchants, making it a convenient and versatile payment option for users worldwide. Additionally, PayPal provides users with buyer and seller protection, safeguarding against fraud and ensuring secure transactions. Furthermore, PayPal offers users the flexibility to choose from various payment methods, including credit cards, debit cards, bank transfers, and PayPal balance, allowing for seamless transactions across different platforms and devices.

Cons of PayPal

While PayPal offers numerous benefits as a payment platform, it is not without its drawbacks. One of the main disadvantages of PayPal is the fees associated with certain transactions, such as currency conversion fees and transaction fees for receiving payments. Additionally, PayPal’s dispute resolution process can be lengthy and complex, resulting in delays and frustration for users involved in disputes. Furthermore, PayPal’s policies regarding account freezing and fund holds have been criticized for their lack of transparency and consistency, leading to inconvenience and dissatisfaction among users.

Time for Linking a Bank Account to PayPal

Difference Between Linking a Bank Account and Debit Card on PayPal. The process of linking a bank account to PayPal typically takes a few business days to complete. After users initiate the linking process by providing their bank account details, PayPal will verify the information by depositing small amounts into the linked bank account. Once users confirm the deposited amounts, their bank account will be successfully linked to their PayPal account, and they can begin using it for transactions and transfers. While the linking process may vary depending on the user’s bank and location, most users can expect the process to be completed within 3-5 business days.

Paying with PayPal

Once users have linked a bank account or debit card to their PayPal account, they can use PayPal to make purchases online or in-store. When checking out at a participating merchant, users can select PayPal as their payment method and log in to their PayPal account to complete the transaction. PayPal will then deduct the purchase amount from the user’s PayPal balance or linked bank account or debit card, depending on the user’s preferences and available funds. Paying with PayPal offers users the convenience of a single payment platform for all their online transactions, streamlining the checkout process and providing added security.

Transferring Money from a Bank Account to PayPal

To transfer money from a linked bank account to their PayPal account, users can initiate a transfer directly from their PayPal account dashboard. After selecting the option to transfer funds from a bank account, users will be prompted to enter the desired transfer amount and select the linked bank account from which to withdraw funds. PayPal will then initiate the transfer, and the funds will typically be available in the user’s PayPal account within 1-3 business days, depending on the user’s bank and location. Transferring money from a bank account to PayPal offers users a convenient way to add funds to their PayPal balance for future transactions or to complete purchases when their PayPal balance is insufficient.

Safely Use PayPal

To safely use PayPal, users should take several precautions to protect their accounts and personal information. Firstly, users should ensure that their PayPal account is secured with a strong, unique password and enable two-factor authentication for an added layer of security. Secondly, users should be vigilant about phishing scams and fraudulent emails posing as PayPal communications, as these may be attempts to steal sensitive information. Additionally, users should regularly monitor their PayPal account for any unauthorized transactions or suspicious activity and report any concerns to PayPal’s customer support immediately. By following these best practices, users can safely use PayPal for their online transactions and protect themselves against potential security threats.

PayPal Asking to Link a Card

It is not uncommon for PayPal to prompt users to link a card to their account, especially if they have not already done so. Linking a card to PayPal offers users added flexibility and convenience when making online transactions, as it allows them to access funds stored in their linked card balance or withdraw funds from their PayPal account to their linked card. Additionally, linking a card to PayPal may provide users with additional security measures, such as fraud protection and purchase guarantees offered by their card issuer. While linking a card to PayPal is optional, it can enhance the user experience and provide added peace of mind when using the platform for online transactions.

Cost to Link Bank Account on PayPal

Linking a bank account to PayPal is typically free of charge for users. PayPal does not impose any fees or charges for linking a bank account to a PayPal account or for initiating transfers between a linked bank account and a PayPal account. However, users should be aware that their bank may impose fees for certain transactions, such as international transfers or currency conversion fees. Additionally, users should carefully review PayPal’s fee schedule for any charges associated with specific transactions or services, as PayPal may impose fees for certain types of transactions, such as receiving payments or withdrawing funds to a bank account. Overall, linking a bank account to PayPal is a cost-effective way to access funds and facilitate transactions on the platform, offering users added convenience and flexibility without incurring additional expenses.

PayPal – Cheaper or Not

Whether PayPal is cheaper than alternative payment methods depends on various factors, including the type of transaction, currency conversion rates, and fees associated with specific services. While PayPal offers certain transactions, such as sending money to friends and family, for free within the same country, it may impose fees for other types of transactions, such as receiving payments for goods and services or withdrawing funds to a bank account. Additionally, users should be aware of any currency conversion fees or international transaction fees that may apply when using PayPal for cross-border transactions or transactions in a foreign currency. Overall, while PayPal offers convenience and flexibility as a payment platform, users should carefully consider the fees and charges associated with specific transactions to determine whether PayPal is the most cost-effective option for their needs.

Conclusion

In conclusion, the decision to link a bank account or a debit card to PayPal depends on users’ preferences, needs, and priorities. While both options offer their own set of advantages and disadvantages, users can choose the option that best aligns with their financial goals and usage habits. Whether users opt to link a bank account for seamless transfers or a debit card for immediate access to funds, PayPal remains a versatile and convenient platform for online transactions, offering users the flexibility to choose the payment method that suits their needs best. By understanding the differences between linking a bank account and a debit card to PayPal and considering the various factors involved, users can make informed decisions about their PayPal usage and enjoy a seamless and secure payment experience on the platform.